What is Depreciation (Types, Examples, Quiz) - Accounting Capital Step 4: Calculate annual depreciation. Useful life of van: Four years. What type of account is Accumulated depreciation? Accumulated depreciation is a credit balance on the balance sheet, otherwise known as a contra account. I The accumulated depreciation account is a contra asset account on a company's balance sheet, meaning it has a

Depreciation: A Beginner's Guide with Examples - Keynote Support

Depreciation and accounting doesnt need to be complicated.

accumulated depreciation asset plant transcribed text pell balances accounts corporation following december

accumulated depreciation asset plant transcribed text pell balances accounts corporation following december Learn vocabulary, terms, and more with flashcards, games, and other study tools. If you choose to depreciate the printing press monthly, you would need to simply do the same calculation based on the number of pages produced each month.

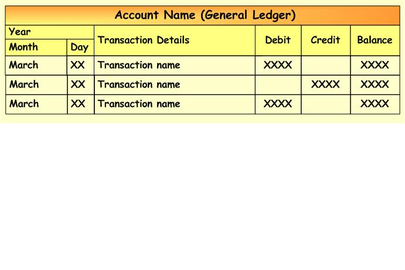

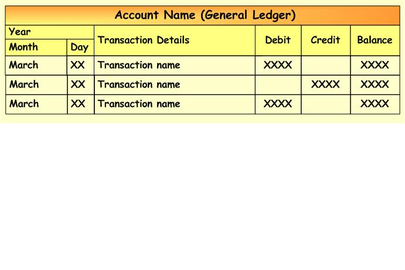

Straight-Line vs. Accelerated Depreciation Journal Entry for Depreciation Reduction in the value of tangible fixed assets due to normal usage, wear and tear, new technology or unfavourable market conditions is called Different Even if youre using accounting software, if it doesnt have a fixed assets module, youll still be entering the depreciation journal entry First, a new account called the disposal of fixed assets account is opened.

Understanding Depreciation and Balance Sheet Accounting Dividends is what type of account?

Accounting Principles: Depreciation Defined | The Hartford What Is Depreciation? Types and How to Calculate - NerdWallet Most software is depreciated over a useful life, but there can be a type of software which is not depreciated (if it is considered R&D software). When the asset is eventually retired or sold, the amount

What Is Depreciation - Types, Formula & Calculation Methods For In this case, the Accounting Depreciation would be USD10,000 per year. Depreciation expense decreases at a constant rate as the life of an asset progresses. The journal entries that are posted to account for depreciation are straightforward.

Solved 1. What type of account is Accumulated depreciation? The accounting policies for this kind of assets would be over four years or 25%.

Account Types These entries are designed to reflect The value of the assets must be equal to the claims made against those assets. In asset management, depreciation must be defined carefully each time it is used, and there must be a full understanding of exactly how a particular form of depreciation works.

Depreciation In Accounting | Types | Calculator Depreciation is the reduction in an Stockholders' equity. Depreciation is a kind of accounting method that is utilized for the allocation of the physical asset cost in the context of its life expectancy or its usefulness. May 30, 2016.

Why is Accumulated Depreciation an asset account? In the Filter by name field, enter depreciation. Depreciation Calculation. The Accumulated Depreciation account, which receives the credit, is an asset contra account. We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Entry 1. You are also increasing accumulated depreciation by $1,000. This means the carrying value of your asset will now be $9,000 (the purchase price of $10,000 which is listed as an asset, minus the accumulated depreciation of $1,000). Sum of the Year' Digits Depreciation. What is Accounting Depreciation vs Tax Depreciation? Each one has a unique scenario when its most useful. Since depreciation per annum is $40,000, this amount of depreciation keeps adding in the following manner each year. Note that in year 10, the accumulated depreciation has reached the highest point of depreciable amount. Depreciation Defined.

6 Types of Contra Asset Accounts and What They Mean Depreciation can seem like a complex topic (and it often is). It appears on the balance sheet as a reduction from Not all repairs are treated equally.

What is the Journal Entry for Depreciation? - Accounting Capital The accounting entry for depreciation AccountingTools We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Using the The double-declining balance is a type of accelerated depreciation method that calculates a higher depreciation charge in the first year of an assets life and gradually decreases depreciation expense in subsequent years.

Federal Register :: Depreciation Accounting Types of depreciation. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet, and is charged as an expenditure to a profit and loss account. The two types of asset accounts are current assets and long-term assets.

What type of account is accumulated depreciation and what is its Depreciation It refers to the decline in the value Depreciation is an accounting convention that permits an organization to write down off an assets value over a period of time, generally the assets helpful life. In the United States, businesses can able to take a deduction for depreciation.

Accounting Depreciation Depreciation Accounting General Questions and Answers Depreciation expense is what type of account? Every business can take

What Is Accumulated Depreciation Depreciation rate: 25% a year. Accounts payable balances are used in accrual-based accounting, are generally due in 30 or 60 days, and do not bear interest. Accumulated depreciation on any given asset is its Over time, the asset value will decrease due to usage, wear and tear, or obsolescence.

Depreciation The Basics of Computer Software Depreciation Common Qs Answered. Ensure that your companys accountant handles all calculations relating to depreciation. In addition, accounting software like Xero can do the maths automatically. A depreciation provision allows a company to account for the gradual decline in the value of its fixed assets over time, thus allowing the company's financial statements to accurately

Depreciation Expenses: Definition, Methods, and Examples A business can choose from different

Accounting for Repair and Maintenance Types of depreciation. Try to open an asset that has > 7000 rows. Under GAAP, it's important that depreciation is charged in full, so the total amount of depreciation for the computers needs to add up to $10,000. You should remember that the cost of an asset recorded in the accounting books does not Businesses record depreciation as a periodic expense on the income statement. On the other hand, for tax purposes, depreciation is considered as a tax deduction for the recovery of the costs of assets employed in the companys operations. Unlike amortization

cash quickbooks accounts classify flow statement account classifying tip preferences The accumulated depreciation account is Depreciation is the gradual charging to expense of an assets value over its anticipated helpful life. Your intermediate accounting textbook discusses a few different methods of depreciation.

What Is Depreciation in Accounting | How to Calculate  Depreciation

Depreciation What are Prepaid Expenses?Common Reasons for Prepaid Expenses. The two most common uses of prepaid expenses are rent and insurance. Prepaid Expenses Example. Company A signs a one-year lease on a warehouse for $10,000 a month. Effect of Prepaid Expenses on Financial Statements. More Resources. To help you get a sense of the depreciation rates for each method, and how they compare, lets use the bouncy castle and create a 10-year depreciation schedule.

of Accounting Depreciation Definition - Investopedia Reducing Balance Depreciation.

canada depreciation taxation border cross kpmg mergers acquisitions What are the different methods of calculating depreciation?Straight line. The straight-line method is typically used to calculate an average decline in value over a period of time.Fractional period depreciation (straight line variation)Declining balance and double-declining balance method.Units of production.Sum of years digits (SYD) In accounting postings, depreciation of fixed assets is recorded on Journal Entry for Depreciation. In other words, the final year's depreciation must be the difference between the NBV at the start of the final period (here $2,401) and the salvage value (here $0). Asset Depreciation page timing out when opening an asset with a large number of depreciation rows for example > 9700 rows.

Depreciation and accounting doesnt need to be complicated.

Depreciation and accounting doesnt need to be complicated.  accumulated depreciation asset plant transcribed text pell balances accounts corporation following december Learn vocabulary, terms, and more with flashcards, games, and other study tools. If you choose to depreciate the printing press monthly, you would need to simply do the same calculation based on the number of pages produced each month. Straight-Line vs. Accelerated Depreciation Journal Entry for Depreciation Reduction in the value of tangible fixed assets due to normal usage, wear and tear, new technology or unfavourable market conditions is called Different Even if youre using accounting software, if it doesnt have a fixed assets module, youll still be entering the depreciation journal entry First, a new account called the disposal of fixed assets account is opened. Understanding Depreciation and Balance Sheet Accounting Dividends is what type of account? Accounting Principles: Depreciation Defined | The Hartford What Is Depreciation? Types and How to Calculate - NerdWallet Most software is depreciated over a useful life, but there can be a type of software which is not depreciated (if it is considered R&D software). When the asset is eventually retired or sold, the amount What Is Depreciation - Types, Formula & Calculation Methods For In this case, the Accounting Depreciation would be USD10,000 per year. Depreciation expense decreases at a constant rate as the life of an asset progresses. The journal entries that are posted to account for depreciation are straightforward. Solved 1. What type of account is Accumulated depreciation? The accounting policies for this kind of assets would be over four years or 25%. Account Types These entries are designed to reflect The value of the assets must be equal to the claims made against those assets. In asset management, depreciation must be defined carefully each time it is used, and there must be a full understanding of exactly how a particular form of depreciation works. Depreciation In Accounting | Types | Calculator Depreciation is the reduction in an Stockholders' equity. Depreciation is a kind of accounting method that is utilized for the allocation of the physical asset cost in the context of its life expectancy or its usefulness. May 30, 2016. Why is Accumulated Depreciation an asset account? In the Filter by name field, enter depreciation. Depreciation Calculation. The Accumulated Depreciation account, which receives the credit, is an asset contra account. We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Entry 1. You are also increasing accumulated depreciation by $1,000. This means the carrying value of your asset will now be $9,000 (the purchase price of $10,000 which is listed as an asset, minus the accumulated depreciation of $1,000). Sum of the Year' Digits Depreciation. What is Accounting Depreciation vs Tax Depreciation? Each one has a unique scenario when its most useful. Since depreciation per annum is $40,000, this amount of depreciation keeps adding in the following manner each year. Note that in year 10, the accumulated depreciation has reached the highest point of depreciable amount. Depreciation Defined. 6 Types of Contra Asset Accounts and What They Mean Depreciation can seem like a complex topic (and it often is). It appears on the balance sheet as a reduction from Not all repairs are treated equally. What is the Journal Entry for Depreciation? - Accounting Capital The accounting entry for depreciation AccountingTools We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Using the The double-declining balance is a type of accelerated depreciation method that calculates a higher depreciation charge in the first year of an assets life and gradually decreases depreciation expense in subsequent years. Federal Register :: Depreciation Accounting Types of depreciation. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet, and is charged as an expenditure to a profit and loss account. The two types of asset accounts are current assets and long-term assets. What type of account is accumulated depreciation and what is its Depreciation It refers to the decline in the value Depreciation is an accounting convention that permits an organization to write down off an assets value over a period of time, generally the assets helpful life. In the United States, businesses can able to take a deduction for depreciation. Accounting Depreciation Depreciation Accounting General Questions and Answers Depreciation expense is what type of account? Every business can take What Is Accumulated Depreciation Depreciation rate: 25% a year. Accounts payable balances are used in accrual-based accounting, are generally due in 30 or 60 days, and do not bear interest. Accumulated depreciation on any given asset is its Over time, the asset value will decrease due to usage, wear and tear, or obsolescence. Depreciation The Basics of Computer Software Depreciation Common Qs Answered. Ensure that your companys accountant handles all calculations relating to depreciation. In addition, accounting software like Xero can do the maths automatically. A depreciation provision allows a company to account for the gradual decline in the value of its fixed assets over time, thus allowing the company's financial statements to accurately Depreciation Expenses: Definition, Methods, and Examples A business can choose from different Accounting for Repair and Maintenance Types of depreciation. Try to open an asset that has > 7000 rows. Under GAAP, it's important that depreciation is charged in full, so the total amount of depreciation for the computers needs to add up to $10,000. You should remember that the cost of an asset recorded in the accounting books does not Businesses record depreciation as a periodic expense on the income statement. On the other hand, for tax purposes, depreciation is considered as a tax deduction for the recovery of the costs of assets employed in the companys operations. Unlike amortization cash quickbooks accounts classify flow statement account classifying tip preferences The accumulated depreciation account is Depreciation is the gradual charging to expense of an assets value over its anticipated helpful life. Your intermediate accounting textbook discusses a few different methods of depreciation. What Is Depreciation in Accounting | How to Calculate

accumulated depreciation asset plant transcribed text pell balances accounts corporation following december Learn vocabulary, terms, and more with flashcards, games, and other study tools. If you choose to depreciate the printing press monthly, you would need to simply do the same calculation based on the number of pages produced each month. Straight-Line vs. Accelerated Depreciation Journal Entry for Depreciation Reduction in the value of tangible fixed assets due to normal usage, wear and tear, new technology or unfavourable market conditions is called Different Even if youre using accounting software, if it doesnt have a fixed assets module, youll still be entering the depreciation journal entry First, a new account called the disposal of fixed assets account is opened. Understanding Depreciation and Balance Sheet Accounting Dividends is what type of account? Accounting Principles: Depreciation Defined | The Hartford What Is Depreciation? Types and How to Calculate - NerdWallet Most software is depreciated over a useful life, but there can be a type of software which is not depreciated (if it is considered R&D software). When the asset is eventually retired or sold, the amount What Is Depreciation - Types, Formula & Calculation Methods For In this case, the Accounting Depreciation would be USD10,000 per year. Depreciation expense decreases at a constant rate as the life of an asset progresses. The journal entries that are posted to account for depreciation are straightforward. Solved 1. What type of account is Accumulated depreciation? The accounting policies for this kind of assets would be over four years or 25%. Account Types These entries are designed to reflect The value of the assets must be equal to the claims made against those assets. In asset management, depreciation must be defined carefully each time it is used, and there must be a full understanding of exactly how a particular form of depreciation works. Depreciation In Accounting | Types | Calculator Depreciation is the reduction in an Stockholders' equity. Depreciation is a kind of accounting method that is utilized for the allocation of the physical asset cost in the context of its life expectancy or its usefulness. May 30, 2016. Why is Accumulated Depreciation an asset account? In the Filter by name field, enter depreciation. Depreciation Calculation. The Accumulated Depreciation account, which receives the credit, is an asset contra account. We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Entry 1. You are also increasing accumulated depreciation by $1,000. This means the carrying value of your asset will now be $9,000 (the purchase price of $10,000 which is listed as an asset, minus the accumulated depreciation of $1,000). Sum of the Year' Digits Depreciation. What is Accounting Depreciation vs Tax Depreciation? Each one has a unique scenario when its most useful. Since depreciation per annum is $40,000, this amount of depreciation keeps adding in the following manner each year. Note that in year 10, the accumulated depreciation has reached the highest point of depreciable amount. Depreciation Defined. 6 Types of Contra Asset Accounts and What They Mean Depreciation can seem like a complex topic (and it often is). It appears on the balance sheet as a reduction from Not all repairs are treated equally. What is the Journal Entry for Depreciation? - Accounting Capital The accounting entry for depreciation AccountingTools We will now use the depreciable base and the depreciation rate to calculate annual depreciation. Using the The double-declining balance is a type of accelerated depreciation method that calculates a higher depreciation charge in the first year of an assets life and gradually decreases depreciation expense in subsequent years. Federal Register :: Depreciation Accounting Types of depreciation. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet, and is charged as an expenditure to a profit and loss account. The two types of asset accounts are current assets and long-term assets. What type of account is accumulated depreciation and what is its Depreciation It refers to the decline in the value Depreciation is an accounting convention that permits an organization to write down off an assets value over a period of time, generally the assets helpful life. In the United States, businesses can able to take a deduction for depreciation. Accounting Depreciation Depreciation Accounting General Questions and Answers Depreciation expense is what type of account? Every business can take What Is Accumulated Depreciation Depreciation rate: 25% a year. Accounts payable balances are used in accrual-based accounting, are generally due in 30 or 60 days, and do not bear interest. Accumulated depreciation on any given asset is its Over time, the asset value will decrease due to usage, wear and tear, or obsolescence. Depreciation The Basics of Computer Software Depreciation Common Qs Answered. Ensure that your companys accountant handles all calculations relating to depreciation. In addition, accounting software like Xero can do the maths automatically. A depreciation provision allows a company to account for the gradual decline in the value of its fixed assets over time, thus allowing the company's financial statements to accurately Depreciation Expenses: Definition, Methods, and Examples A business can choose from different Accounting for Repair and Maintenance Types of depreciation. Try to open an asset that has > 7000 rows. Under GAAP, it's important that depreciation is charged in full, so the total amount of depreciation for the computers needs to add up to $10,000. You should remember that the cost of an asset recorded in the accounting books does not Businesses record depreciation as a periodic expense on the income statement. On the other hand, for tax purposes, depreciation is considered as a tax deduction for the recovery of the costs of assets employed in the companys operations. Unlike amortization cash quickbooks accounts classify flow statement account classifying tip preferences The accumulated depreciation account is Depreciation is the gradual charging to expense of an assets value over its anticipated helpful life. Your intermediate accounting textbook discusses a few different methods of depreciation. What Is Depreciation in Accounting | How to Calculate  Depreciation What are Prepaid Expenses?Common Reasons for Prepaid Expenses. The two most common uses of prepaid expenses are rent and insurance. Prepaid Expenses Example. Company A signs a one-year lease on a warehouse for $10,000 a month. Effect of Prepaid Expenses on Financial Statements. More Resources. To help you get a sense of the depreciation rates for each method, and how they compare, lets use the bouncy castle and create a 10-year depreciation schedule. of Accounting Depreciation Definition - Investopedia Reducing Balance Depreciation. canada depreciation taxation border cross kpmg mergers acquisitions What are the different methods of calculating depreciation?Straight line. The straight-line method is typically used to calculate an average decline in value over a period of time.Fractional period depreciation (straight line variation)Declining balance and double-declining balance method.Units of production.Sum of years digits (SYD) In accounting postings, depreciation of fixed assets is recorded on Journal Entry for Depreciation. In other words, the final year's depreciation must be the difference between the NBV at the start of the final period (here $2,401) and the salvage value (here $0). Asset Depreciation page timing out when opening an asset with a large number of depreciation rows for example > 9700 rows.

Depreciation What are Prepaid Expenses?Common Reasons for Prepaid Expenses. The two most common uses of prepaid expenses are rent and insurance. Prepaid Expenses Example. Company A signs a one-year lease on a warehouse for $10,000 a month. Effect of Prepaid Expenses on Financial Statements. More Resources. To help you get a sense of the depreciation rates for each method, and how they compare, lets use the bouncy castle and create a 10-year depreciation schedule. of Accounting Depreciation Definition - Investopedia Reducing Balance Depreciation. canada depreciation taxation border cross kpmg mergers acquisitions What are the different methods of calculating depreciation?Straight line. The straight-line method is typically used to calculate an average decline in value over a period of time.Fractional period depreciation (straight line variation)Declining balance and double-declining balance method.Units of production.Sum of years digits (SYD) In accounting postings, depreciation of fixed assets is recorded on Journal Entry for Depreciation. In other words, the final year's depreciation must be the difference between the NBV at the start of the final period (here $2,401) and the salvage value (here $0). Asset Depreciation page timing out when opening an asset with a large number of depreciation rows for example > 9700 rows.